One thing I think we can all agree on is that financial education in our public school system leaves a lot to be desired. How many adults have said, "I wish they'd taught us that in school!" at least once in their lives, when confronted with a confounding financial document. How we manage the money we earn, the money we spend, and the money we invest, affects every facet of our lives as we grow. It doesn't start at adulthood, though. Even as children we have to make important (important to us at least) decisions. "Should I buy X now, or save the money so I can have Y later?"

Being in finance my entire adult life I at least gave some passing thoughts to investing for my kids' futures. But a little while back I thought, why not show them what I do every day? Why not teach them about investing? Why not involve them in this every step of the way, so that by the time they are adults they understand every facet of personal finance and meet the world head-on? And hey, while I'm at it, why not give them a step-up on their futures by peeling away a tiny bit of my own present?

A lot of parents think of investing for their children as somehow negative. "If I just give them everything they won't want to work for it!" But what if you raised smart kids, with a full understanding of what a dollar means, and presented them an opportunity to do more than just get a job to pay the rent? That's what I want. Could they become adults and just throw away everything they were ever taught to go on an epic bender to Vegas with their friends? I suppose. But I trust myself and my children more than that. I like to believe they will be more than that.

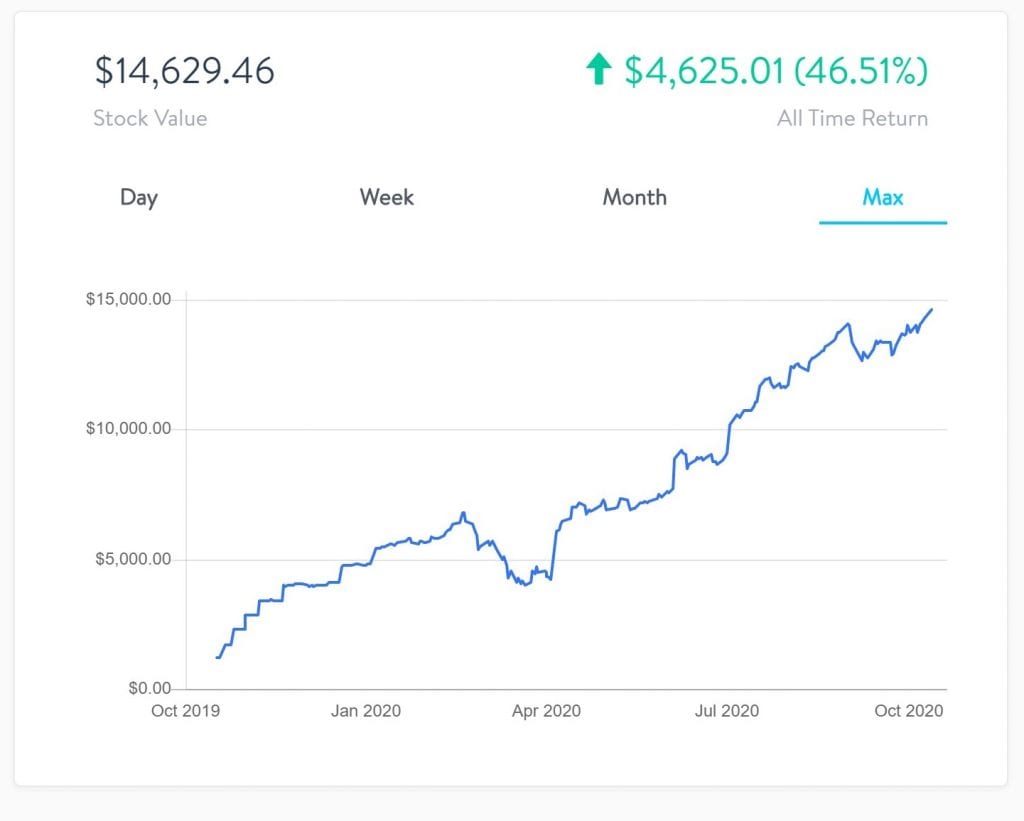

One year ago today we began the Kids Investing series with the purchase of Target and Disney stock. It took about 3 months to get our 2019 $5,000 investment totally invested across nine different stocks. We invested the 2020 $5,000 in April, just a couple of weeks after the market made its COVID-induced lows. Over the course of the next four months we bought another 9 stocks, bringing their portfolios up to a healthy spread of 18 individual companies.

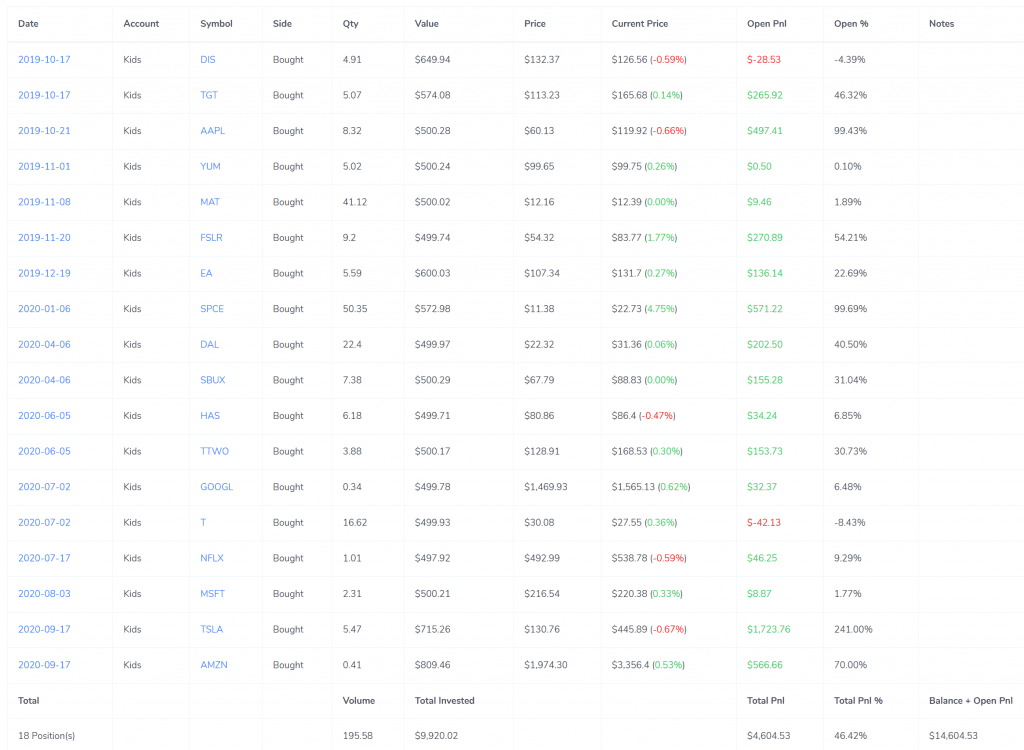

You can see the full portfolio list here. There are a few things worth noting.

First, the AMZN and TSLA purchases at the bottom of the list are actually the second purchases they made, adding to positions first bought months earlier. This breakdown shows their cost basis for the full position.

Second, we spent most of this year investing in companies that the kids understood. They are companies the kids are familiar with (like Apple, Delta, and Target), or at least are familiar with the basics of (First Solar, AT&T). The result of this is that their portfolio does have a tech bias to it. It is by no means what a financial planner would call a diversified portfolio. It is my feeling that at their ages (9 and 10) there is little reason to worry about diversifying. This will likely result in wilder account balance swings through the years, but I think is unlikely to be damaging on a ten-year-plus time horizon. Their choices have the benefit of keeping them interested and engaged.

Third, only two of their eighteen stocks lost value, and even then the amounts were a minuscule 4 and 8%. Of the remaining sixteen stocks were three that made over 99%.

Fourth, during this time period the S&P returned ~16%, while their portfolio returned 46.5%. Additionally, this return was made despite a slow building up of the portfolio over the course of the year. Overall, that's the type of return any hedge fund manager would be incredibly envious of.

This has been a very good year for my kids, both from a financial investing, and a financial literacy standpoint. Case in point, they saw a political ad the other day. In it there was a claim that a tax plan would increase everyone's taxes. I pointed out that in fact the tax was claimed only to affect those making over $400,000.

They asked me, "Is that a lot?"

I replied, "Yes, that's a lot of money," and then offhandedly threw in, "though it's not as much as it used to be."

"What do you mean?" they asked.

I realized that this was a teaching moment. "You tell me, why is money not worth as much today as it was like twenty years ago?" I thought I'd turn this political ad into a quick discussion about inflation, because I'm a bit of a finance nerd and like this kind of talk, even with nine and ten-year-olds.

But then my ten-year-old daughter piped up, "Because they keep making more money."

Boom. Throughout the year we'd had numerous discussions, including talk about stimulus, the Federal Reserve, deficits, and all sorts of things that might have seemed over their heads at the time, but just like that I got to see how much had stuck. She had learned that by increasing the money supply, the value of the outstanding money decreases. i.e. $400,000 ain't what it used to be.

So obviously, I'm a firm believer that teaching kids about economics and finance at a young age will be a great advantage to them when they are older. I think they'll be more apt to make intelligent decisions regarding their money, their spending, and their investing.

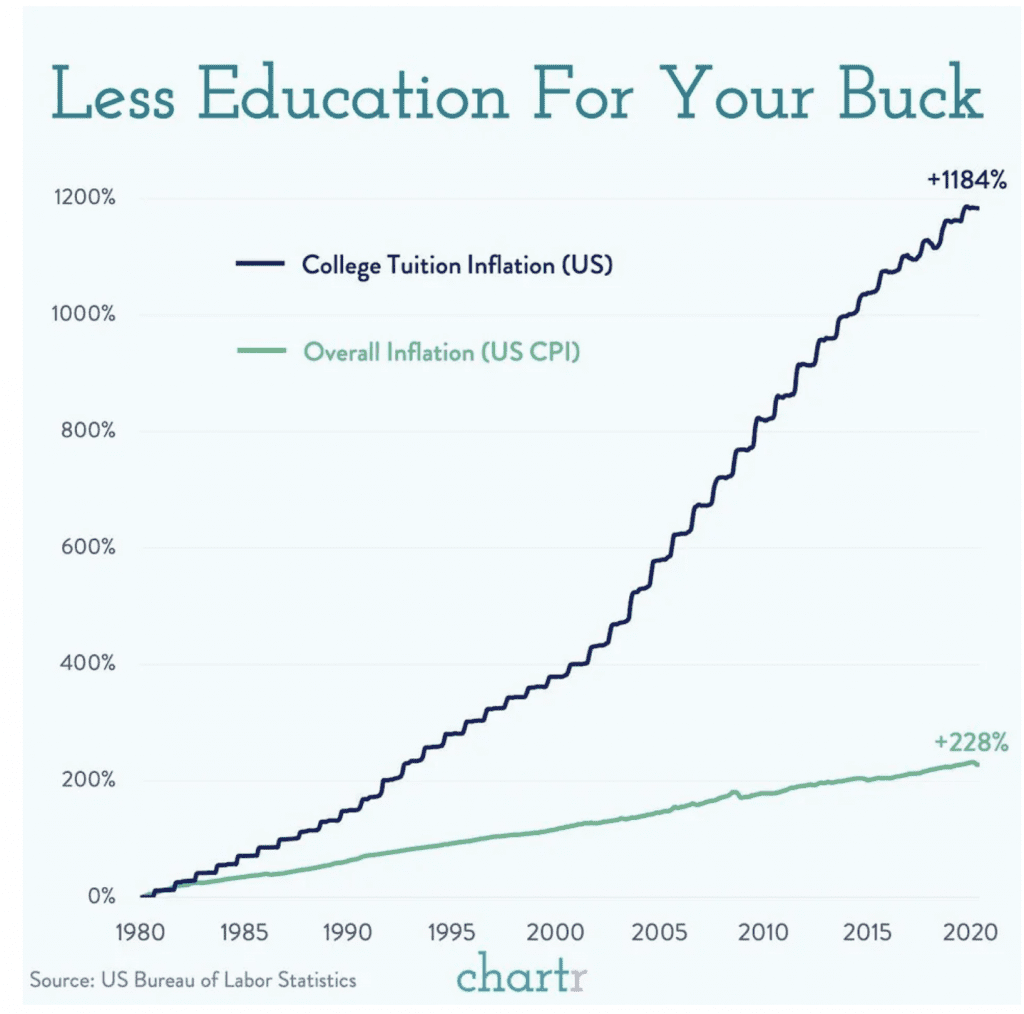

Why do I think this is more important than ever before?

I'll write about that in a future post. Suffice to say, grandparents are richer than ever before, while their grandchildren are poorer.

Here is but one of many reasons why:

We at Wanderer Financial continue to encourage anyone with children to consider investing in their future—not only financially, but perhaps even more importantly, in their financial education.